Finding a Motorcycle Insurance Agency

Motorcycle riding and pursuing the motorcycle lifestyle is one of the most thrilling things life has to offer (well we might be a little biased). But it’s not all just fun and games. Safety and making sure you’re protected from start-to-finish of each ride is extremely important, and part of that protection is protection through a quality motorcycle insurance agency.

Bike insurance can vary in terms of necessary coverage, state laws, and price points depending on what you are going for. Often, this could take hours of time from your day researching the different options instead of actually getting out there on your motorcycle.

Luckily, we’ve created a handy guide to pricing options, how to get a quote, and what kind of state-specific coverage you should be looking at. Read more about how to get adequate peace of mind at the right price from a motorcycle insurance agency

Types of Motorcycle Insurance

All states require you to have some form of liability insurance as a motorcycle owner. However, the determination of what type can vary state-by-state, and there are lots of choices to navigate. The bare minimum for liability coverage will be about the same amount as car insurance minimums, but we recommend going well beyond that to take care of you and your assets. Here are some the three most common premium options:

- Comprehensive Coverage: This type of insurance policy will pay out if there is theft or non-collision damage to your motorcycle, including animal damage or vandalism. There is typically a deductible.

- Collision Coverage: This will deal with damages done while your motorcycle is in motion. When searching for the most cost-effective insurance, it is important to note not only the cost of the coverage, but the financial amount that will be covered when you make a claim as well.

- Personal Injury Protection: This coverage pays out the medical bills for you, your passengers, or anyone involved in an accident (even pedestrians). Some states do not allow motorcycle PIP insurance because of increased accident rates, but it is becoming more common.

- Underinsured or Uninsured Motorist Coverage: This option is common in order to protect your finances if you are in a collision with an at-fault driver who either does not have any insurance, or adequate insurance on their vehicle. Over 10 percent of all drivers in the United States are without insurance, so this can save you from having to foot the bill of an accident.

In addition to these types of static insurance, certain agencies have add-ons such as trip interruption coverage, custom parts coverage, roadside assistance. Whichever of these you choose, it is important to shop around for multiple quotes and consider which fits your bike, budget, and lifestyle best.

Best Motorcycle Insurance Agencies

When trying to categorize the best motorcycle insurance agencies, there are many factors: Cost, customer service, state-by-state policies, and coverage quality.

There are many quality providers, and if you are looking to research alternatives including quick online insurance quotes, here is a directory of quality providers. What is most important is that you explore coverage before you ever get on a bike, and make sure it suits your needs. With the right insurance policy, you can ride with peace of mind.

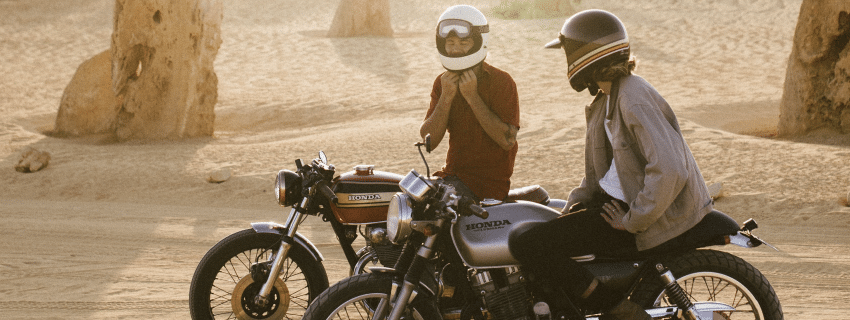

Enjoy the Ride – Law Tigers Has Your Back

Law Tigers has been providing motorcycle owners with a stress-free riding experience for multiple decades now. As riders ourselves, we understand the need to be covered for any situation. That’s why we’ve worked to become the number one source of representation for motorcycle injury accidents and know what a good insurance provider can do for you in these instances.

At Law Tigers, motorcycle riding is in our blood. We’ll see you out on the road!

Back to Top